Ideal Info About How To Apply For Working Family Tax Credits

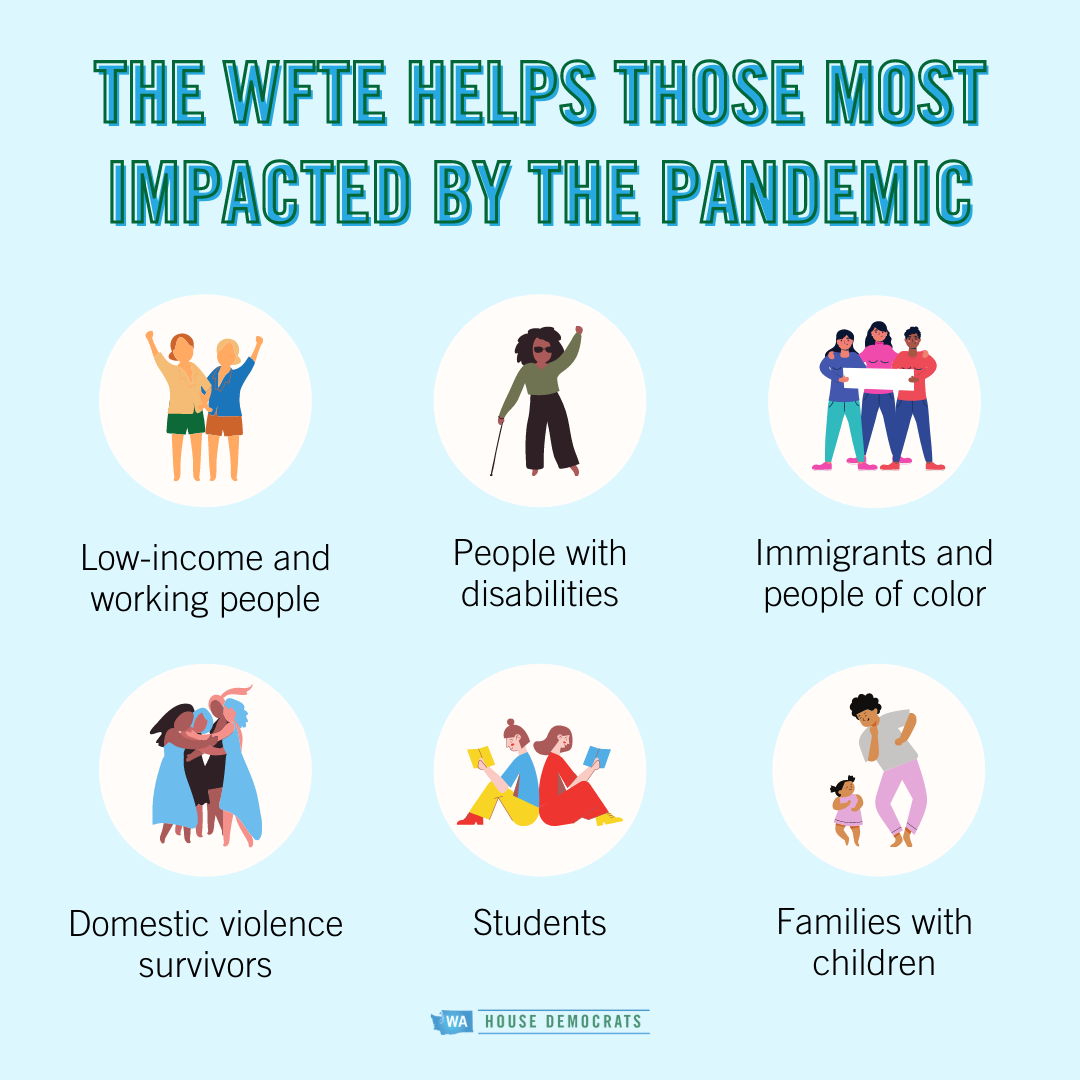

Individuals and families are eligible for the working families tax credit if they meet all of the.

How to apply for working family tax credits. If you applied and were eligible for the credit, you'll. The campaign for working families, inc. Free tax help working families credit (wfc) working families credit (wfc) the 2021 wfc application deadline was april 18, 2022.

How many dependant children you have (kids under 18 you are financially responsible for). The tax credit will equal up to three thousand dollars ($3,000) or 50 percent of the total cost of the construction, acquisition, and installation of the qualified storm shelter at the. Before registering you will need:

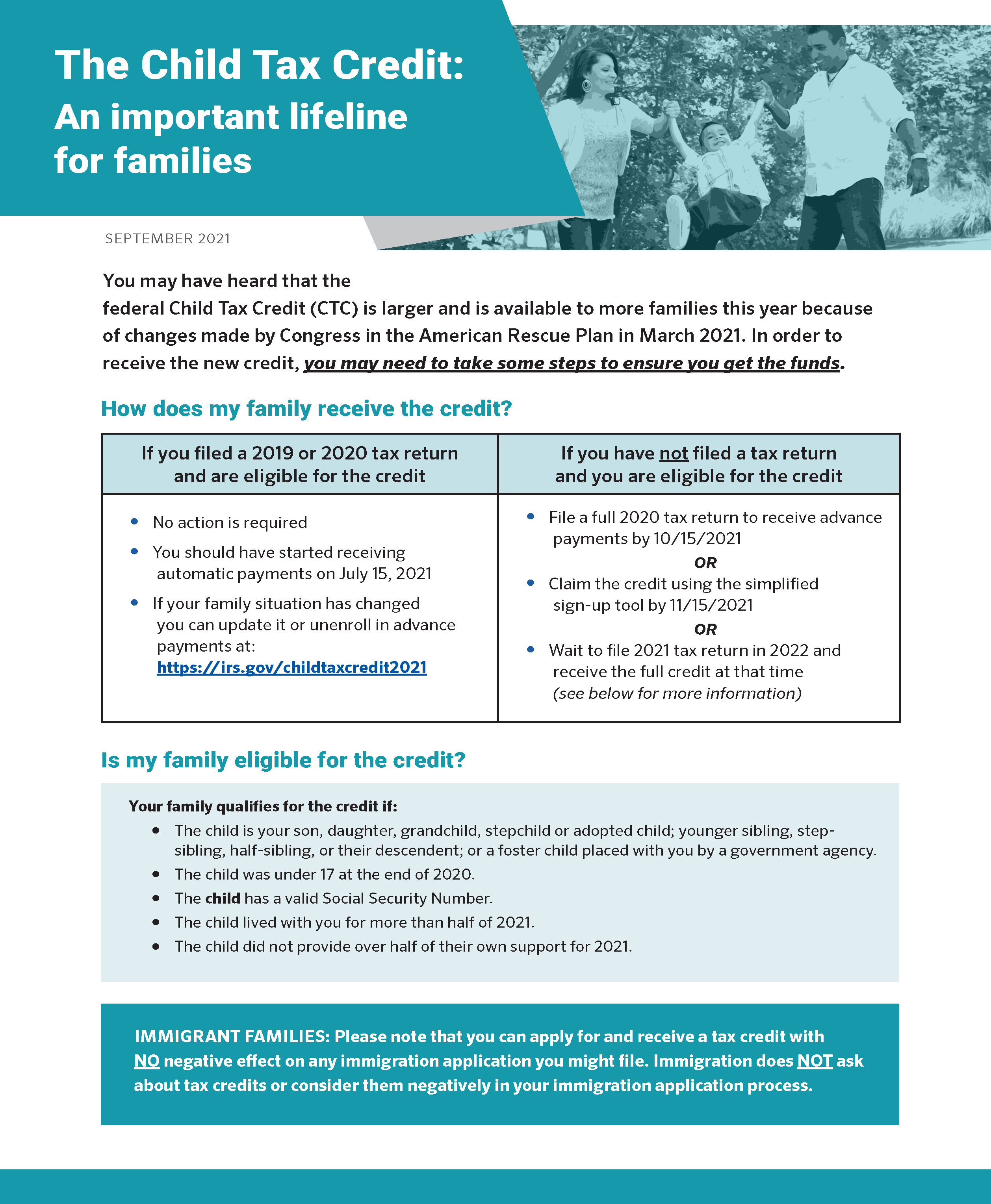

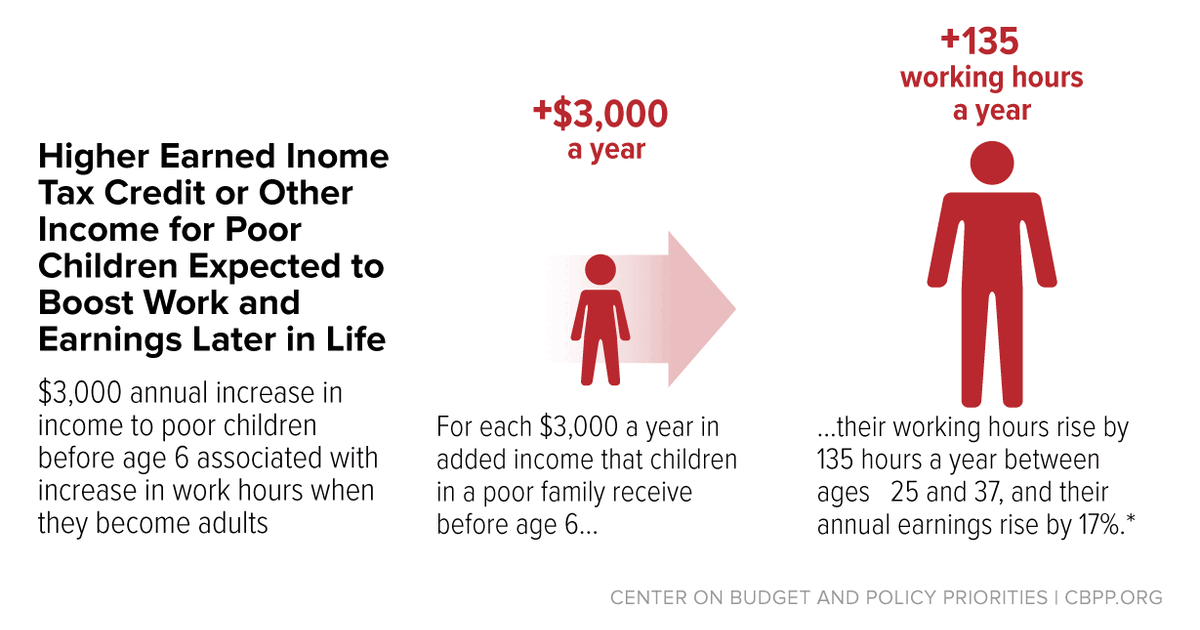

Employers must apply for and receive a certification verifying the. You can register for working for families and best start in myir or by using our online form. $3,000 to $3,600 per child for nearly all working families.

You can apply for universal credit instead. Take the amount that exceeds the 50%. If you received advance payments of the child tax credit, you need to reconcile (compare) the total you received with the amount you’re eligible to claim.

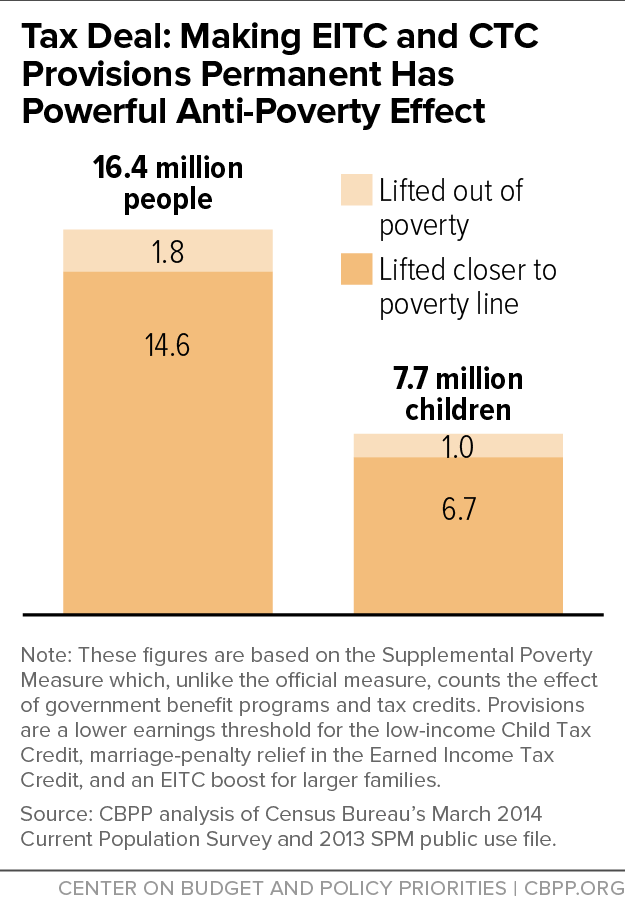

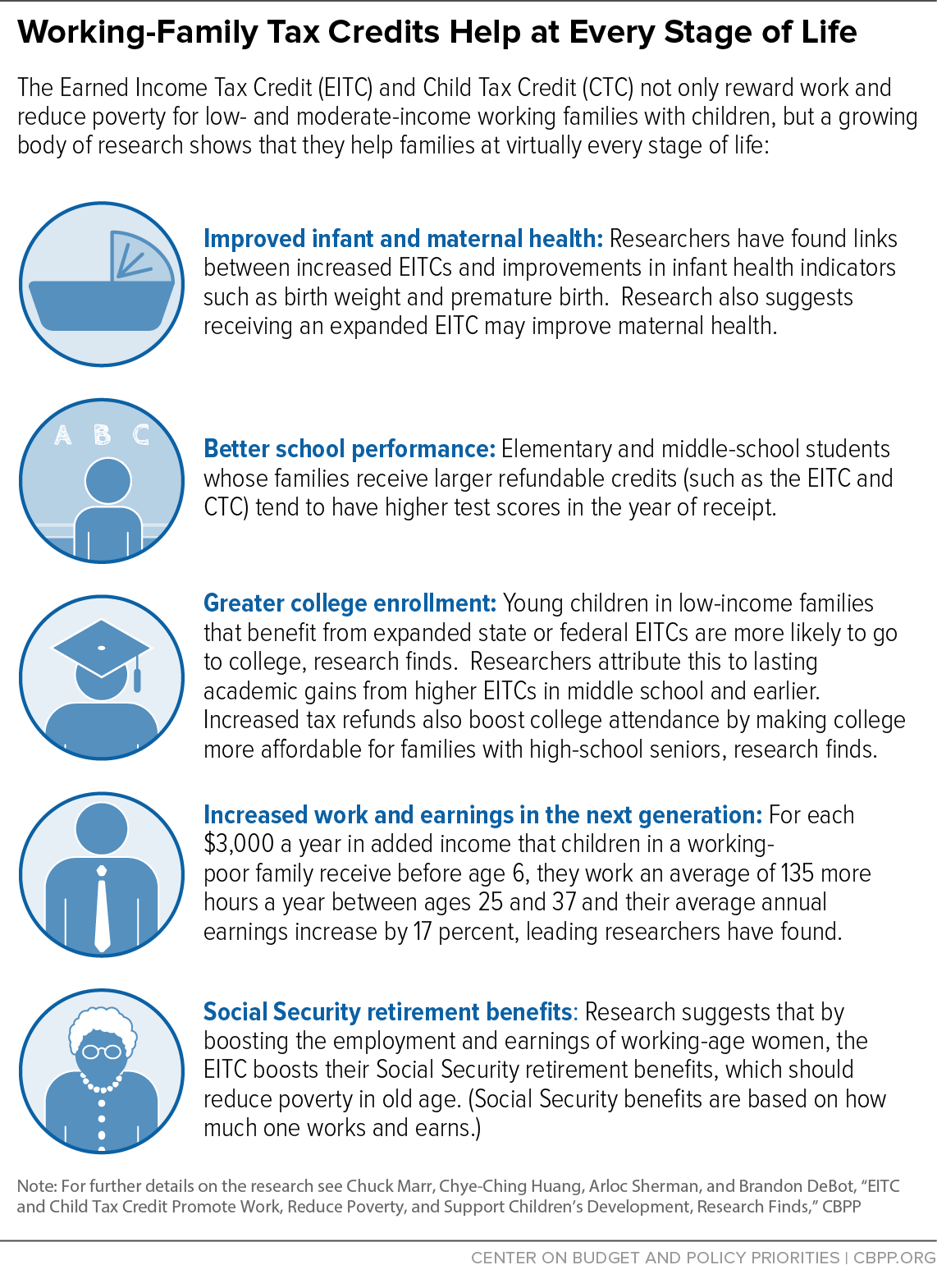

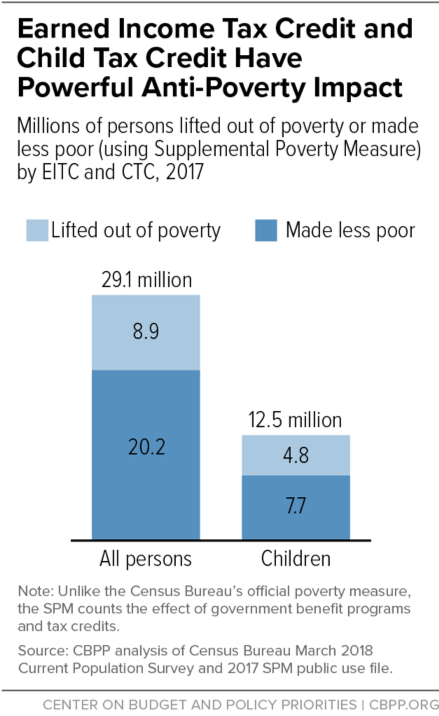

Major tax relief for nearly all working families: You can also apply for back years if you think we owe you payments. Those who are restricted by the internal revenue service (irs) from claiming the eic.

The type of payment and the amount you will get depends on: You cannot apply for working tax credit. You must work a certain number of hours a week to qualify.

The child tax credit in the american rescue plan provides the largest child tax credit. The tax credit may not exceed the lesser of (1) the total cost of installing the sprinkler system; Employers may meet their business needs and claim a tax credit if they hire an individual who is in a wotc targeted group.

Applications open in 2023 for the 2022 tax year and are accepted through december 31, 2023. How much you can get. Usually, at least 24 hours between you (with 1 of you working at least 16 hours) a child is someone who is under.

Complete schedule m1wfc, minnesota working family credit, to see if you are eligible for this credit.