Spectacular Tips About How To Fight A Property Tax Increase

The property tax value is based on facts.

How to fight a property tax increase. To fight against rising property tax bills, texans have two steps to follow. Abatements help property owners reduce or eliminate. “you may qualify for benefits that will help keep your property tax bill manageable by reducing the taxable value of your home, reducing your tax rate, or ‘locking in’ the taxable.

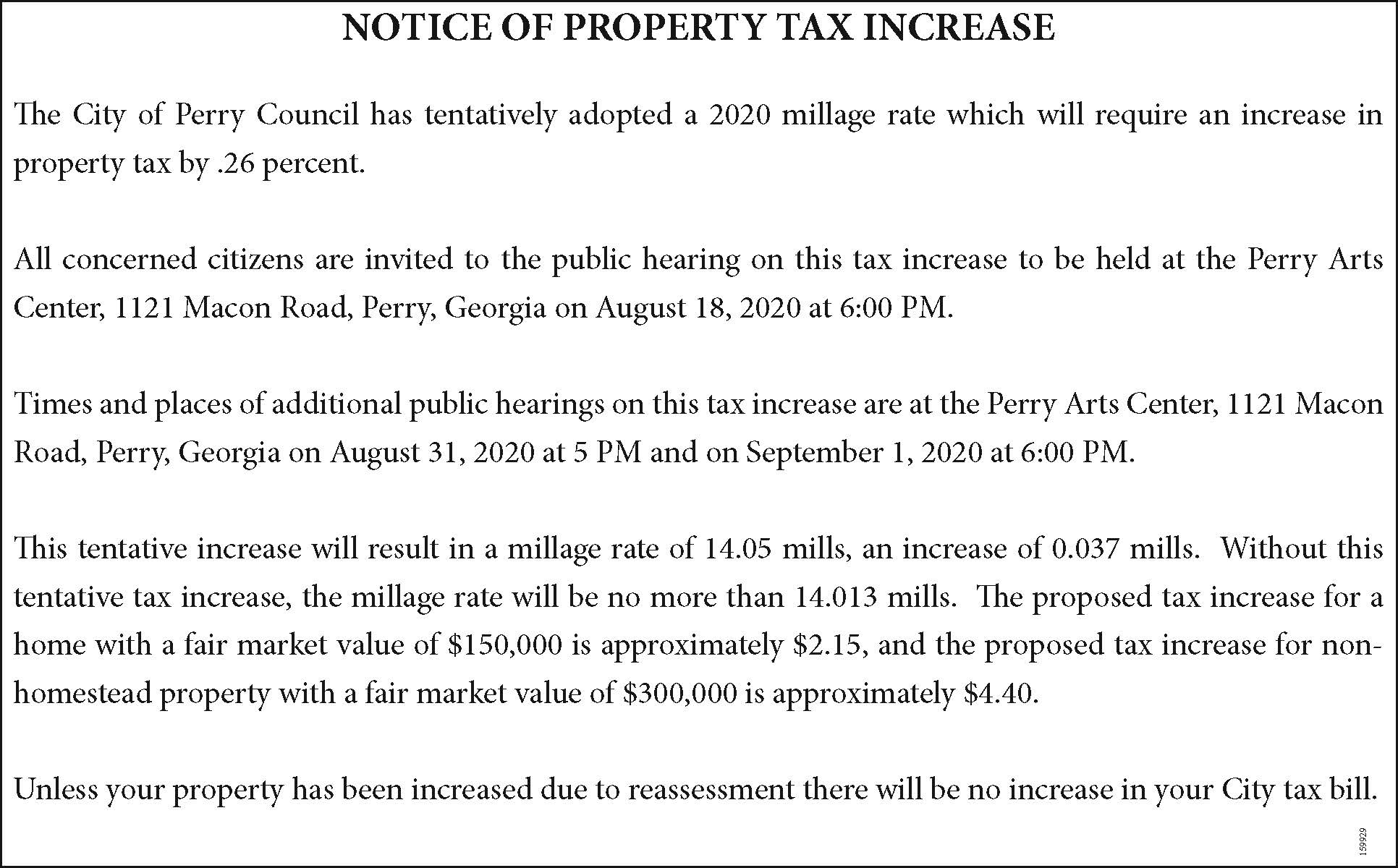

First and foremost, understand that when you are negotiating with an appraiser at the appraisal district, you are protesting your property value, not your property taxes. As soon as you receive your proposed property tax. If you want to know how to increase your income—to fight inflation, reach your money goals quicker, or just get some more margin in the budget each month—then we’ve got.

If approved, it would be the first increase in the county's portion of the. You should have received a floor plan and boundary survey when you bought your house. The first problem for many owners who want to reduce their tax burden relates to the timing of the pandemic.

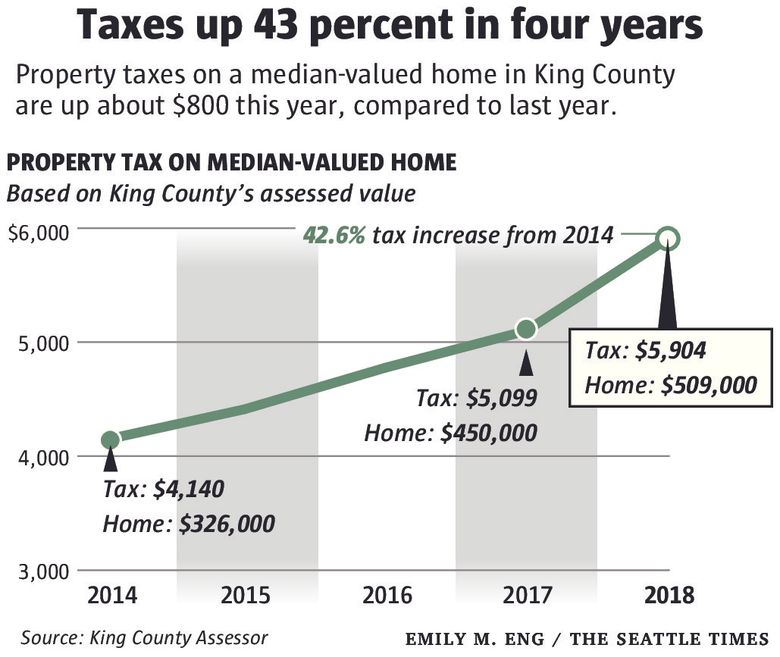

The larger of the two facilities had its tax assessment value rise 39 percent, from $3.25 million to $4.52 million, which would result in taxes increasing from about $49,000 to $68,000. She brought the sketch to the assessor’s office and wound up saving $1,000.”. Property tax appeal procedures vary from jurisdiction to jurisdiction.

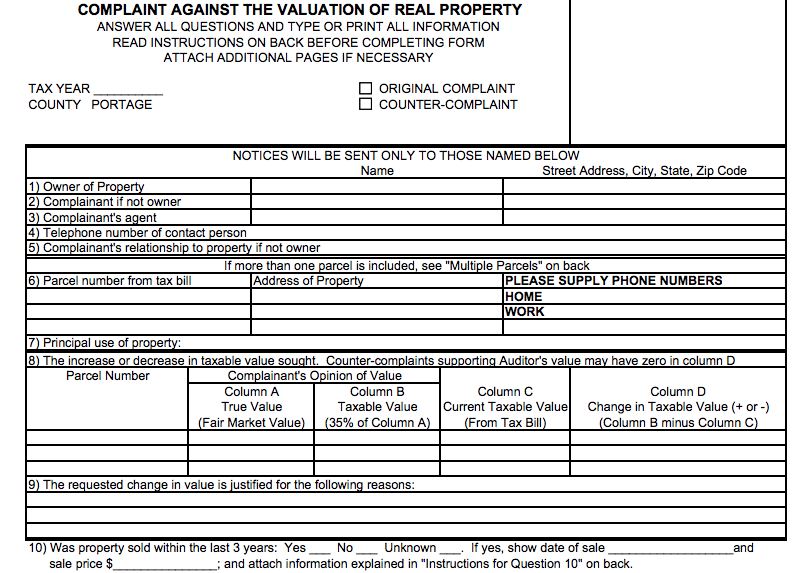

Most jurisdictions give you 90 days after you receive a new assessment to appeal, although some close the appeals window after 30 days, says pete sepp, president of the. Consider using a property tax lawyer to fight for you and save time. By statute, you have from may 1.

Give the assessor a chance to walk through your home—with you—during your assessment. 12 tips to cut your tax bill this year. You usually just have to pay a portion of your tax savings during the first year.

Here's how to appeal your property tax bill, step by step: If you can show she wrote down the wrong square footage for your house or the number of bedrooms, or that she missed. Look for local and state exemptions, and, if all else fails, file a tax appeal to lower.

Sometimes our property values go up for good reason, but more times than not they change due to a blanket adjustment in a geographical area. 3 hours agowelsch said dropping the increase to 4.4% for a nearly $117.8 million levy would eliminate options for adding county staff and limit equipment replacement to the most urgent. Read your assessment letter local governments periodically assess all the real estate they tax.

The ordinance did pass raising property taxes from.74 cents to.80 cents,. 23 hours agoan unusually large crowd attended the meeting to voice their disagreement to raise property taxes. To win an appeal, you want proof that your neighbors who live in a house comparable to yours pay less in taxes than you do.

Contact your tax assessor and find how she determined your value. 1 day agokane county board members a considering a property tax increase of 3.5% or 5% as part of the 2023 budget. See if you qualify for a homestead exemption if you are age 65 or older, which can exempt taxes on.

.png)