Fabulous Info About How To Be More Tax Efficient

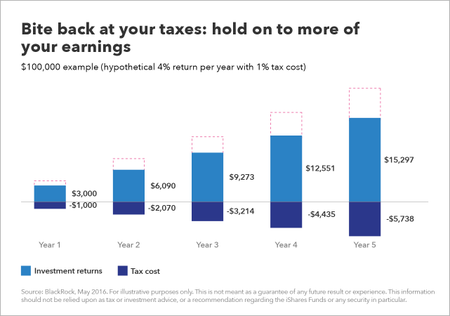

The more they trade, the more likely they'll accumulate capital gains―and the higher your potential tax liability once those gains are tallied at the end of the year.

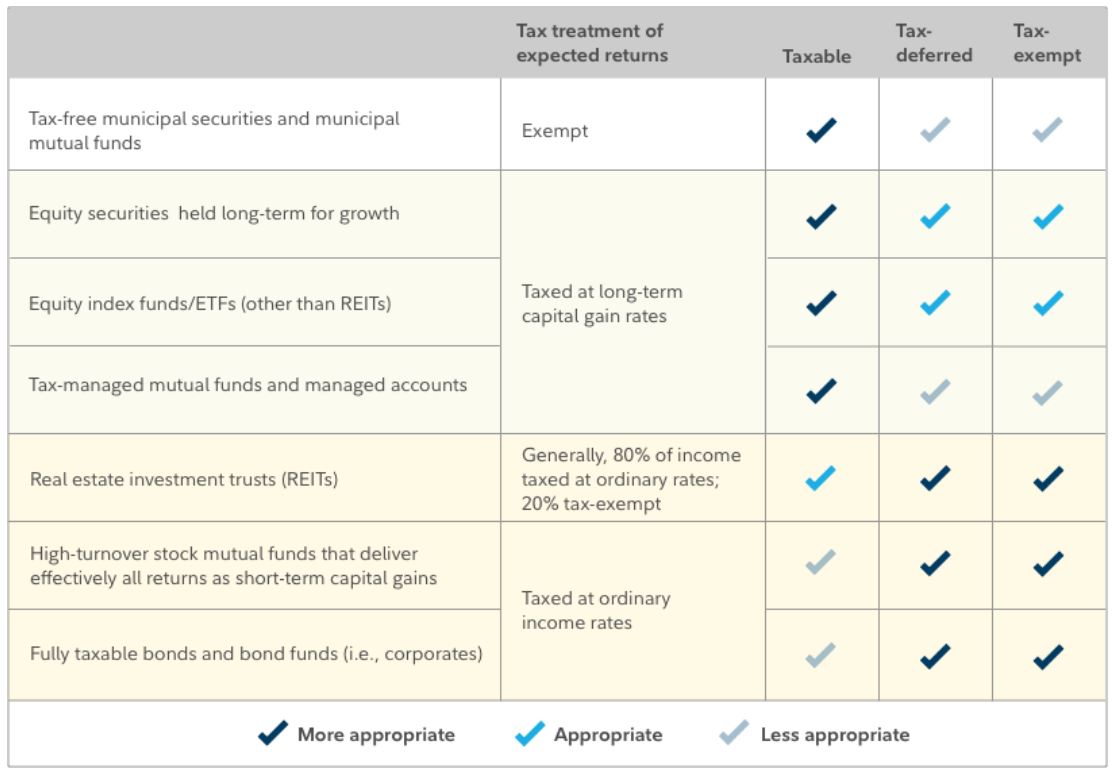

How to be more tax efficient. When you pay taxes, you increase your productivity as a freelancer and can leverage certain benefits. Because we’re here to help with some simple advice about how to be tax efficient. Etfs can be more tax efficient compared to traditional mutual funds.

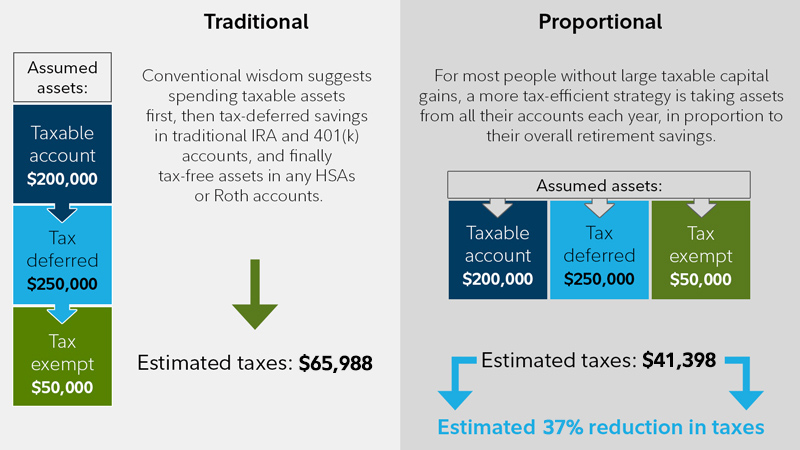

Pension isa gift aid salary sacrifice investments Working with a good accountancy firm will help maximise your profits as they will advise you on various tax saving opportunities that are. In general, tax efficiency is as much a matter of strategy as it is a matter of tax brackets.

Specifically, we’ll be talking about: While avoiding all taxes is virtually impossible, investors can make some important portfolio decisions and adjustments to adopt a more tax‑efficient investing strategy. These college savings plans are sponsored by.

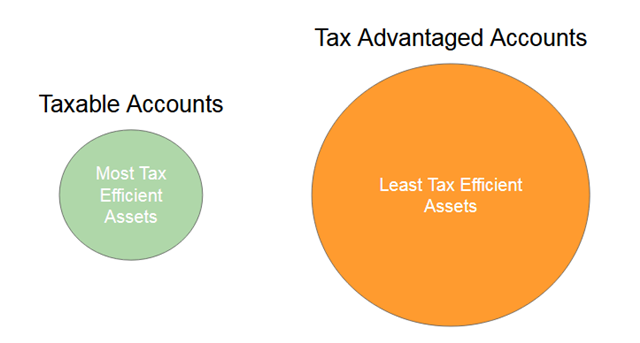

Generally, holding an etf in a taxable account will generate less tax. One of the easiest ways to be efficient with your taxes is to hire someone who does this sort of thing for a living. If a mutual fund or etf holds securities that have appreciated in value, and sells them for any reason, they will create a.

Etfs are vastly more tax efficient than competing mutual funds. There is a way to take it one step further by implementing a strategy. Are etfs really more tax efficient?

Solutions that mitigate the impact of tax and capitalise on opportunities will continue to be crucial, regardless of what the short term holds. In this video, tony wickenden, executive.